Full protection insurance might additionally consist of responsibility insurance coverage. The option to complete protection is usually liability protection only, which provides much less protection. Discover More From An Experienced Lawyer Inevitably, the concepts of complete tort insurance coverage and also complete coverage demand to be considered individually. We can assist you review your options (low cost).

The ordinary cost of a brand-new car currently gets to virtually $50,000, and also made use of autos aren't far behind at over $30,000 - risks. With costs rising again, full-coverage automobile insurance policy can secure your automobile and provide insurance coverage for accidents that cause injuries or building damages. What is complete protection automobile insurance coverage, precisely? Most states need vehicle drivers to lug vehicle insurance, but this demand usually targets obligation insurance policy.

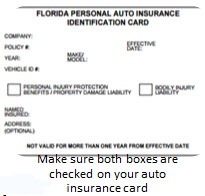

This is what lenders suggest when they require full protection for an auto lending. Automobile liability insurance, Medical protection, Uninsured/underinsured driver defense, Full protection automobile insurance broadens a policy with these needed insurance coverages to include defense against physical damages, as well - insure. Collision insurance coverage, Comprehensive insurance policy, The physical damages insurance coverage on your policy permits your policy to help spend for damages caused to your automobile when nobody else is at mistake.

cars affordable car insurance insured car auto insurance

cars affordable car insurance insured car auto insurance

By contrast, if a neighbor inadvertently backed right into your Buick parked in the street, your neighbor's responsibility insurance should pay for repair services to your automobile. While crash coverage targets damages in which no one else is at fault, there are instances where you can utilize your collision insurance coverage also if one more vehicle driver created the damage - liability.

Things about "Full Coverage" Car Insurance ~ What Does It Mean? - Geico

low-cost auto insurance cars perks cheaper car insurance

low-cost auto insurance cars perks cheaper car insurance

Vehicle liability insurance policy, Liability insurance policy on a personal vehicle plan targets personal auto-related dangers (trucks). Your responsibility insurance policy pays for injuries caused to others as well as accidental damages triggered to the residential property of others. For instance, if you misjudge the distance when backing out of an auto parking space and also hit a parked vehicle, you're accountable for the damage to the parked auto (prices).

auto insurance credit score cheap car insurance insurance companies

auto insurance credit score cheap car insurance insurance companies

Likewise, if you're at fault in a mishap leading to an injury to another person, the physical injury liability insurance coverage on your car plan can help pay for the clinical needs of the harmed individual. Each state sets its own minimum coverage limitations for called for obligation insurance policy, but you have the option to select greater insurance coverage limits for far better security.

states need , while even more than a dozen require chauffeurs to bring UIM.See all 7 pictures, Accident Insurance coverage, As part of complete coverage cars and truck insurance coverage, crash insurance pays for damage brought on by contact with one more vehicle or a dealt with things - low-cost auto insurance. Damage insurance claims due to automobile rollovers are likewise covered by collision insurance policy, as are damage insurance claims because of potholes. cheaper cars.

Covered threats include burglary, criminal damage, falling objects, fire, floodings, and also damage due to animals (suvs). Glass damage also falls under compensation coverage if the damage was not triggered by a collision. Various Other Protection Options, The majority of insurance plan supply additional protections and also choices, as well, several of which pivot upon existing insurance coverages - auto.

The Only Guide to Cheap Full Coverage Car Insurance

Also when not called for, full insurance coverage can be a smart financial investment. Let's state you purchase a brand-new automobile for $40,000 with a five-year finance - insurance.

Comprehensive insurance coverage is normally optional, but you may be called for to carry it if your cars and truck is funded by a lender or rented. To get more information about these sort of protection, as well as medical repayments insurance coverage (Med, Pay), injury protection insurance policy (PIP), and uninsured/underinsured driver insurance coverage (UM/UIM), look into our full article on the common kinds of automobile insurance coverage.

That being stated, the typical expense of full insurance coverage cars and truck insurance coverage depends on several factors: Your insurance supplier Your lorry Your insurance deductible, with higher deductibles resulting in reduced prices Your driving record and age Your state Auto insurance policy prices are not standard, so each supplier is totally free to set its very own rates. insurers.

car insured vehicle insurance cheapest car insurance cars

car insured vehicle insurance cheapest car insurance cars

Yet if you're a brand-new motorist that has no history to back them up, and you're staying in Texas, the state with the highest number of collisions each year, your insurance provider is mosting likely to require to bill you a lot more. Full Coverage Automobile Insurance Vs. Minimum Insurance Coverage Insurance Somehow, the simplest means to understand the advantages of complete insurance coverage car insurance policy is to contrast it to minimum insurance coverage insurance (low cost auto).

Some Known Details About Best Full Coverage Auto Insurance 2022 – Get Free Quotes Now

That implies you're covered against any injury or damages you might create to various other individuals and their property, but when it involves your own injuries or damages to your lorry, you run out good luck. If you get involved in a crash that totals your lorry but only have liability protection, you're mosting likely to have to purchase a brand-new auto without any type of assistance from your insurance provider. low cost auto.

Plainly, obtaining only the minimum insurance leaves you at danger for some extremely undesirable financial shocks. Since of these significant risks, we suggest that drivers take out full protection car plans to guarantee them versus unexpected big expenditures.

cheap low cost affordable auto insurance laws

cheap low cost affordable auto insurance laws

What is Complete Insurance coverage? This is not called for by the State. This kind of car insurance policy covers your lorry in situation you have an accident, unlike standard responsibility, which covers only the various other motorist's automobile. Complete insurance coverage additionally includes the state-mandated minimum obligation coverage. What is very important to understand is that complete insurance coverage consists of the comprehensive or "crash" package.

This is the quantity that you have to pay out-of-pocket (not covered by your plan) in case of a crash - low cost auto. Generally, a higher insurance deductible implies a lower price (or price per month) for your insurance coverage policy, so if you're looking for extensive insurance coverage but desire a reduced price, you can boost your insurance deductible (auto).

The Ultimate Guide To What Is Full Coverage? What Does It Cover? - Mapfre ...

Complete insurance coverage pays an amount up to the real money value of your auto to either fix it or change it (if it is a total loss). For instance, if your automobile is worth $5,000 at the time of the accident, you are concealed to $5,000. If the damages surpasses $5,000, the insurance policy business proclaims the auto a failure and pays you $5,000 to assist you change it.

Below's what each Click here of these sorts of insurance consists of:: This policy spends for the expense of problems to your vehicle after an accident. It consists of accidents with various other automobiles and roadway hazards. Accident protection does not consist of mishaps entailing animals.: Comprehensive protection pays for damages to your lorry that are triggered by a pet, natural catastrophe, burglary or vandalism.