The only drivers for whom thorough insurance policy is not suggested are those that drive older designs that have low real cash money values - cheapest car. Thorough automobile insurance coverage will cover all problems to the lorry, up to the restrictions stated in your plan.

Accident insurance is another optional, yet really usual, kind of protection. auto. Accident insurance pays for the damages to your very own vehicle after a crash, no matter if you were at mistake or not. This would also be useful in one-car crashes entailing just you collapsing into something and not another person.

One term that is often misinterpreted is comprehensive automobile insurance coverage. Several individuals assume that extensive vehicle insurance coverage is a comprehensive kind of protection that consists of liability, accident, as well as more.

This can influence your costs, as offenses and also accidents are linked with bad driving habits. As you can see, thorough and accident insurance plans complement one an additional. That's why they are often suggested with each other for a large range of security. How Much Does Comprehensive Cars And Truck Insurance Coverage Expense? The Insurance Information Institute (III) estimates the ordinary expense of comprehensive car insurance policy to be around.

What Is Comprehensive Insurance? - Ramseysolutions.com Things To Know Before You Buy

cheaper cheaper cars car insurance credit

cheaper cheaper cars car insurance credit

auto insurance cars car insured car

auto insurance cars car insured car

About 77 percent of insured chauffeurs have detailed coverage, according to the III. To aid you decide whether to get this coverage or not, right here are some inquiries you should ask yourself.

You will not need detailed protection if your automobile deserves less than your insurance policy deductible combined with yearly coverage. Service providers won't pay even more than your car deserves. If you discard this insurance coverage, nonetheless, make certain to establish money apart for the cost of repair services or also a brand-new automobile - vehicle insurance.

The threat of natural calamities is an additional reason to get this coverage. Floodings and twisters can quickly trigger major damage to your car and also also total it if you live in areas vulnerable to them. Your auto might be more in danger if you often tend to park it on the road rather of in a garage.

Among the oldest automobile insurance providers on the listing, Erie supplies an excellent extensive auto insurance plan that covers criminal damage, storms, dropping objects, animal-related damages, as well as windshield splits and also chips. Different types of theft are additionally included in this policy, consisting of auto burglaries and also taken cars (money). In some states, fundamental automobile rental insurance coverage is instantly included with your detailed auto insurance.

Things about Auto Insurance: Are You Covered?

Farmers extensive insurance policy is quite conventional. Your insurance policy rates will certainly be identified by the kind of car and also loss background.

dui insurance trucks cheap car

dui insurance trucks cheap car

Insurance coverage isn't encompassed collision with objects if you are accountable for an automobile accident. You may or might not be billed a deductible for this coverage. Contact your neighborhood agent for more information. In a protected mishap, this insurance can be prolonged past your own automobile to consist of short-lived substitute cars, new automobiles, and also automobiles in use that aren't had by a participant of your family.

A Guardian's Overview: Exactly how To Assist Teenager Drivers Be Safe We wish we can aid both you and also your teenager really feel much more certain about hitting the trail with these tips - vans.

If a vehicle driver hits a pet while driving and also the automobile suffers damages, it is thorough insurance coverage that kicks in to cover the cost of repair work. While some vehicle loan providers need customers to lug detailed insurance coverage, it is usually optional. One of the most detailed insurance coverage will certainly spend for fixings is based upon the cash money value of the car.

All about What Is A Comprehensive Car Insurance Claim? - Bankrate

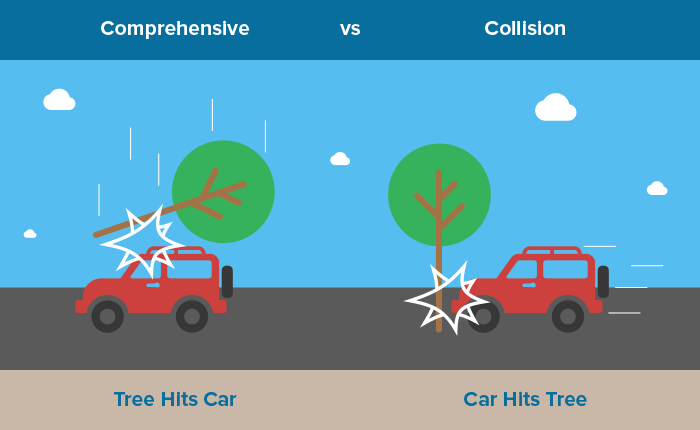

Allow's state a deer encounters a roadway, as well as the driver swerves to avoid hitting the animal. insurance. Rather, the vehicle runs right into a tree. That case would certainly not be covered by comprehensive insurance however by collision protection. Right here are a couple of other instances of what thorough automobile insurance does not cover: Rolling a car, Hitting an additional object or automobile, Being struck by an additional car, Regular wear and tear on a vehicle, Why obtain comprehensive vehicle insurance coverage? As careful as a motorist might be, it is impossible to predict how a cars and truck could be damaged.

No person expects a wildfire to capture their auto on fire, and also for the majority of people, having a car taken comes as a surprise (insurers). Detailed automobile insurance fills the spaces, covering numerous fixings that are not covered by crash insurance. Thorough car insurance coverage limits as well as deductibles, Comprehensive auto insurance coverage includes limits and deductibles.

In various other words, an insurance firm will certainly not pay $5,000 to fix an automobile worth $2,000. Let's claim a tree drops on an automobile causing $7,000 in damages, as well as the driver carries a $1,000 insurance deductible.

Allow's take this step further and think of the broken auto just has a cash value of $4,000. If that held true, the driver would certainly pay $1,000, as well as the insurance coverage business would certainly pay $3,000 (low-cost auto insurance). If the lorry deserved less than the driver's insurance deductible, the driver would certainly be on the hook for the whole repair service.

The Buzz on What Is A Comprehensive Car Insurance Claim? - Bankrate

The reduced the deductible on an insurance coverage strategy, the greater the insurance policy price. On the other hand, the higher the insurance deductible, the lower the insurance price. What is the difference in between crash as well as comprehensive insurance coverage? Essentially, accident insurance coverage is implied to cover cars and truck mishaps, while thorough insurance policy covers losses that are not the result of vehicle crashes.

What is the distinction between comprehensive as well as complete protection? Once again, detailed car coverage shields against the sorts of hazards it is difficult to prepare for, like wildfires, burglary, criminal damage, storms, and animals when driving - credit score. Complete insurance coverage consists of both crash as well as extensive insurance coverage security. It is the most full auto insurance coverage a driver can buy.

suvs prices car insurance companies

suvs prices car insurance companies

Auto insurance policy is the very best means to do that - vehicle. For those not exactly sure just how to begin, this short article can help.

Comprehensive insurance policy becomes part of what insurance firms often call a "full-coverage automobile plan." Still, if you buy or lease a new car, you might require added protection to complete its protections - car insurance. Right here you'll learn more about this sort of insurance coverage in terrific detail, so you can determine whether it's a clever acquisition for your cars and truck or whether to do without.

3 Simple Techniques For Comprehensive And Collision Coverage : Farmers Insurance

Various other insurance coverage policies might. Get in touch with your property owners or occupants insurance policy for conditions on taken things. Just How Thorough Auto Insurance policy Functions Let's state you arise from your residence after a windy evening to find that a tree branch has dropped onto your auto's roofing, leaving a substantial damage. Your extensive insurance policy covers this kind of damages, so you can file a claim and also await your payment.

Pick your insurance deductible wisely due to the fact that it puts on every claim you file. Actual Money Value Payment Normally, thorough insurance policy pays actual cash money worth for your automobile if it is taken or totally completed by a protected risk such as a flood (money). Note, this is not the amount you spent for the cars and truck.

Most renting companies as well as lenders need you to purchase the coverage for leased as well as financed cars. Lenders won't have much to claim once you've made your last cars and truck repayment, however, as well as it is up to you. However you need to look to your own situation to choose. If you can manage comprehensive coverage, it may still be an excellent suggestion.

Accident Insurance coverage Many people are puzzled by having greater than one sort of insurance policy relate to their automobile. The essential thing to keep in mind about crash and extensive coverages is that they do not overlap. Collision insurance policy pays to fix or replace your car if it is harmed or totaled in a collision with one more lorry or object.

5 Easy Facts About Collision Click here for more info Vs Comprehensive Auto Insurance In New York Shown

Comprehensive Protection (additionally referred to as "Apart from Crash" protection) is often referred to as "fire as well as theft (insure)." An even more accurate summary is loss to your lorry triggered by aside from accident. This consists of insurance coverage versus risks such as hitting an animal, vandalism, trouble, floods, wind and hail storm, in addition to fire as well as burglary.

This post will look at: What is covered under extensive automobile insurance? Extensive automobile insurance policy covers damages to or destruction of your vehicle by events other than an accident or collision. If a peril covered by your thorough insurance plan problems or ruins your car, it will certainly pay for repair work or substitutes as much as your policy dollar limit.

Note that neither insurance coverage will cover medical or lawful expenses resulting from an accident or automobile damage. Those costs are usually covered by an additional chauffeur's obligation insurance coverage, medical settlements insurance coverage or individual injury defense - car insurance.